Blog

plant based

14 MARZO 2023

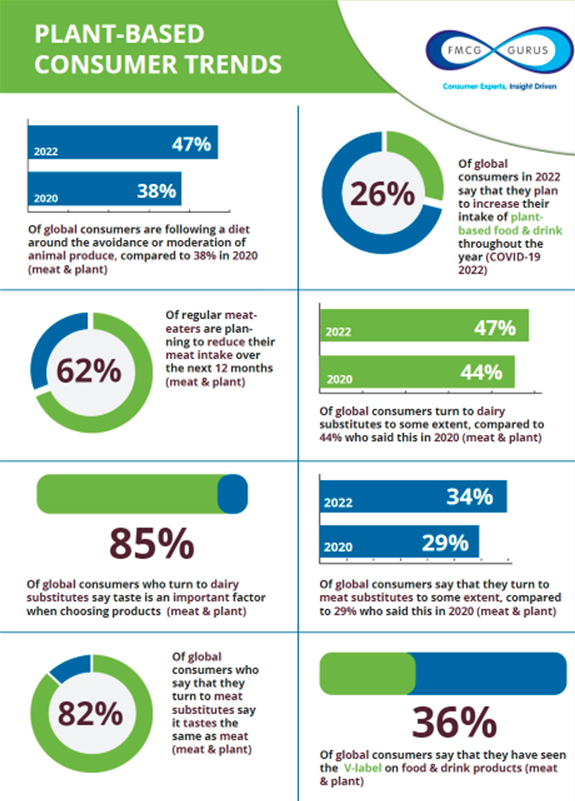

Consumers around the world are increasingly including plant-based products in their diets, and the number of people identifying themselves as flexitarians has increased, from 26% in 2020 to 31% in 2022, according to data from FMCG Gurus. The proportion of vegetarian and vegan consumers has also increased, to 10 % and 3 % respectively, up from 8 % and 2 % in 2020. However, it is the growing interest in plant-based foods from those who also eat animal products that led to an increase in new product development, as well as a new focus on making foods that replicate the flavors and textures of their animal-based counterparts. In fact, 89% of those choosing alternatives to meat and dairy do not consider themselves vegetarians, according to NPD Group figures.

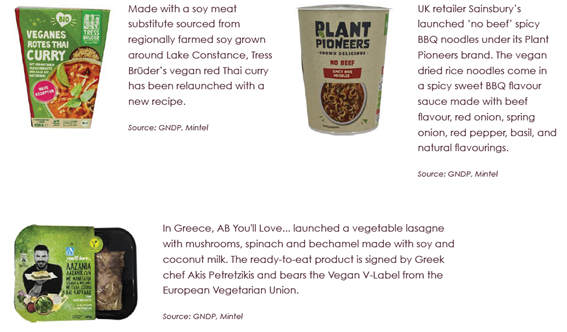

Previously, animal-free alternatives constituted an entirely separate product category aimed at vegetarians and vegans. The latest products, on the other hand, are designed to appeal to the 'plant-curious' as well, texture and cost remain limiting factors, but ingredient suppliers and product developers have made significant progress in recent years.

As interest in plant-based alternatives has grown, so has the market for different formats. Once dominated by soy milk, the plant-based dairy sector now includes a wide variety of alternatives to cheese and yogurt, for example. In the meat alternatives category, products that mimic whole cuts such as steak, chicken, fish fillets and even ribs now join traditional vegan and vegetarian burgers, ground beef and sausages.

Innovations by category

Meat alternatives

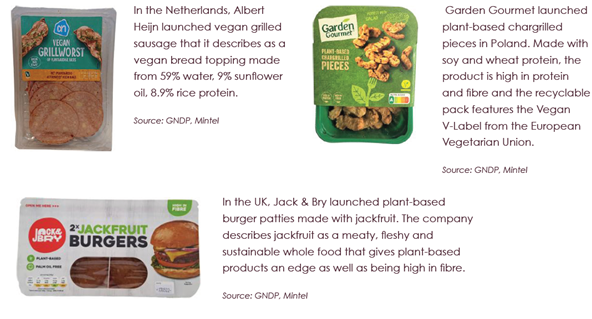

The range of products that mimic meat now goes well beyond burgers, nuggets and sausages. Whole cuts such as steaks and fillets are now on the menu, as are specialty products such as vegan ribs and seafood.

Frozen meat alternatives have been a leading category for innovation, driven by convenience demand, according to ProVeg International, but it advises companies to also look for adjacent market opportunities, particularly whole cuts. The number of new plant-based products in this space has skyrocketed in recent years. Companies include Israeli startups such as Mooji Meats and Chunk Foods, Japan's Next Meats recently debuted its plant-based flank and rib steak in California.

In seafood alternatives, companies include Vegan Zeastar, which makes sashimi-style tuna and salmon alternatives, as well as plant-based shrimp and squid, while Good Catch uses a blend of peas, chickpeas, lentils, soybeans, fava beans and white beans to make tuna and salmon alternatives, and has recently introduced whole plant-based fish fillets and crab cakes.

According to the Plant-Based Foods Association, plant-based chicken was "a growth leader in 2021 as more products that match the taste, texture and appearance of animal-based chicken hit retail shelves," and has highlighted the rise of whole foods. cutting plant-based meats as "the next big trend in the category."

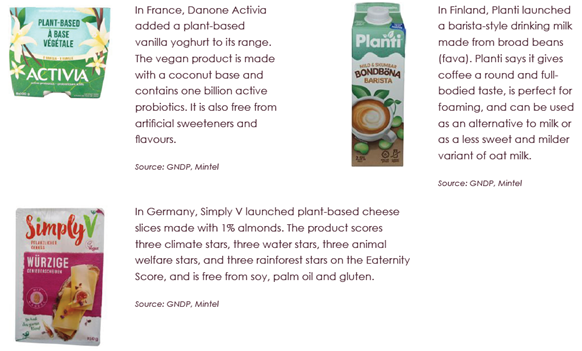

Dairy alternatives (cheese and yogurt)

Before the pandemic, dairy alternatives were already growing rapidly, at a rate of 7.6% per year for yogurt and cheese alternatives, 8.5% for milk alternatives and 32.3% for ice cream alternatives, according to Food Trending figures. According to Jamie Rice, director of global data and information at Food Trending, these products received a sales boost from Covid-19, with a longer shelf life than traditional dairy products.

"[It] started as a niche for strict vegans or those with health issues or lactose intolerance, it wasn't long ago that these products were only available in health food stores."

Cheese and yogurt alternatives generally fall into two categories: those that aim to mimic only the taste and texture of their dairy-based counterparts, often using blends of vegetable fats and starches, and those that use cheese- and yogurt-making methods to create products that also have similarities in nutrition and fermented flavor notes. Increasingly, consumers are opting for the latter, for a more complex and authentic dining experience and a shorter ingredient list.

And the category is not just about new companies. Major dairy companies are diversifying to meet the growing demand for plant-based products. Nestlé, Danone and Fonterra are among the big names that have invested in dairy alternatives in recent years. In dairy-free yogurt, for example, Danone dominates, but dairy-free cheese remains highly fragmented.

Tools for plant based product development

- Alternative protein sources:

Sunflower, potato, lentil, chickpea, mushroom, seaweed, wheat, soybean, pea. - Innovative and technological alternatives to meat are no longer just plant based:

Cultured cells and 3D printing are already a reality. - Proposal for flexitarian consumers:

Hybrid proposals (animal + vegetable protein). - Natural colors - COLORING FOOD:

Coming from fruit and vegetable extracts Food enters through the eyes! - Multi-benefits:

Nutritional and functional ingredients to encourage health-conscious consumers to try plant-based products. - Clean label and organic ingredients:

Consumers prefer familiar, natural and organic ingredients.

Source:

Fi Global insight. Plant-based Report 2022. https://issuu.com/figlobalinsights/docs/plant-based_report_2022_fie2022